One fear above all others makes business owners lose sleep. It’s the same fear your cash flow forecast can fix…

The fear of running out of money.

The cash flow forecast helps you to sleep in peace by giving you confidence in how much money your business will have in the bank within the next few weeks or months.

In this article you’ll find cash flow forecasting videos with examples.

It’s just a plan, of course, so it’s not going to be 100% accurate. Nevertheless, it’s a key tool to get control over your finances.

Often called a cash flow projection, it is your best tool to keep your bank account in the black.

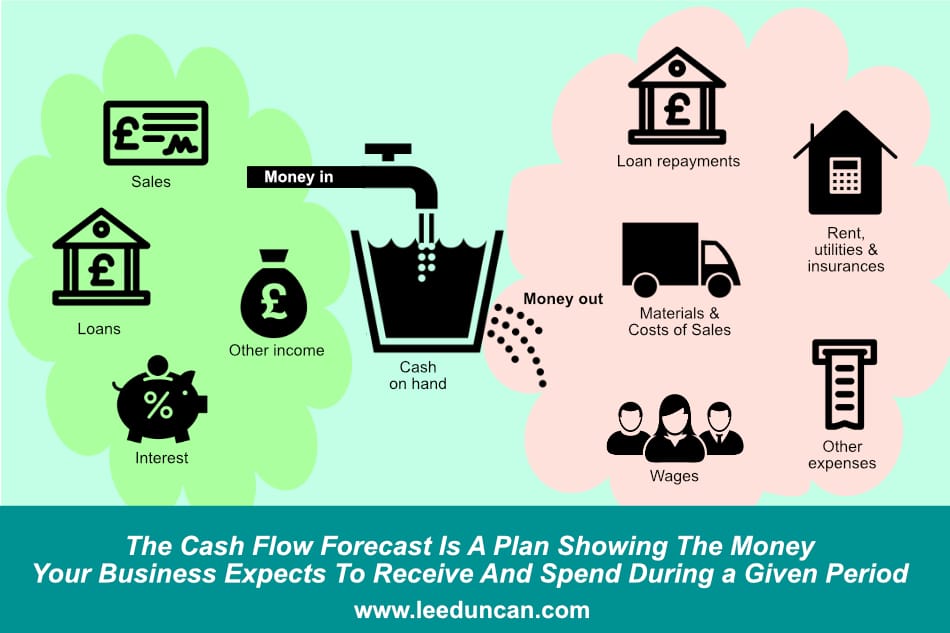

A cash flow forecast is a plan that shows you how much money you expect your business to have during a given period.

In practice, most business owners suffer a lot of sleepless nights because they don’t use cash flow forecasting to help them plan and manage the money in their business.

This article will help you take control, accurately predict cash flow, and sleep better at night.

What Is Cash Flow Forecasting?

Cash flow is the movement of money in and out of your business. Often people get confused and want to increase profit when their focus needs to be on cash flow.

It’s easy to get confused by accountant-speak, that special language that some accountants seem to talk.

The easy way to think about cash flow is that it’s only about moving money in and out of your business. It’s about receiving and spending cash, via cards, bank transfers, cash payments and any other method that results in a movement of money.

For example, if your business borrows £20,000 as a loan from the bank, cash flows into your business when the bank transfers the cash to you.

As you spend money and make repayments to the loan over the following months, that cash flows out of your business.

This cycle of cash flowing in and out is repeated across your business as money from sales flows in and all the costs of your business flow out.

Your cash flow projection is a simple way to predict how much your business will have in the bank at any moment in time.

You can use a cash flow forecast to help you manage the business.

If your business allows people to pay 30 days after invoice, this creates a delay in the cash flow. You make the sale, but get paid later.

It’s only when your customer settles the account by paying the amount on the invoice that the money ‘flows’ into your business.

During this time, your business will have to cover any costs associated with making the sale and staying open. The money your business needs to keep running is called your working capital.

So it’s really simple – cash flow describes the inflows and outflows of the actual money.

The Questions Your Cash Flow Forecast Answers…

Cash flow forecasting is a way of answering the questions that might otherwise keep you awake at night.

“Will I have enough money at the end of the month to pay myself after I’ve paid my staff?”

“Will the sales we are making be enough to cover the tax bills?”

These are typical questions that cause a great deal of stress and anxiety.

By planning and predicting the movements of money, your cash flow forecast takes away uncertainty.

You will become more confident in your financial position and that goes a long way to eliminating uncertainty, fear and anxiety.

Life is hard enough for business owners. A cash flow forecast will reduce stress and make it a little easier. It’s well worth your time to learn how to do this.

Why Is A Cash-Flow Forecast Important?

The great value of cash flow projections is to give you a ‘financial crystal ball’ for your bank account.

Imagine that you are estimating cash flows and realise that you’re going to run into overdraft at the end of the month.

Armed with this information, you have the chance to look at ways to avoid running out of money.

- You could look to quickly reduce some expenses

- Postpone placing orders for new stock or equipment

- Delay your dividend payment so that you don’t take money until there’s more money in the account

- Pay a supplier a little later than usual

- Chase your customers for payments a little more assertively (even better, introduce proper credit control processes).

From the above list of actions, you can appreciate the benefit that cash flow forecasts deliver to you.

They provide a virtual safety net with more time to act to protect your business when income does not come in as quickly as expenditure goes out.

Every year, banks produce reports that examine the reasons for business failures.

The number one cause of business failures every time is problems with cash flow – i.e. running out of money. There is no need for so many of these failures when you could have projected cash flow accurately and taken action to improve things.

Case-Study: From Overdraft To £60K In The Black

Here’s a real-world example of how cash flow projections improved the financial strength of a small manufacturing business within a matter of a couple of months.

Manufacturing business X sold an average of £1,000 per customer to around 600 independent retailers.

On the surface, the business was very successful. Sales were at their highest ever level and the products were all profitable. Their balance sheet showed healthy sales, but that payments were slow to come in.

The simple truth? Too many customers were very slow to pay their invoices.

Sound familiar?

The business was running in overdraft, effectively subsidising these late-payers. Every quarter and at the end of the tax year, there was a real battle to find the money to pay their tax bills.

Behind the scenes, the two directors were suffering a lot of stress and getting fed up with it all.

Despite doing great work and growing a happy, large customer base, there never seemed to be any money in the bank.

For one of the directors, the financial strain was causing enormous tension in her shoulders.

Painful muscle spasms disrupted her sleep every night.

Her neck muscles were so stiff that her head tilted involuntarily towards her shoulder; she couldn’t straighten up even if she tried.

She was getting short-tempered and grumpy. Proof positive that running a small business can be bad for your health!

Yet business should not be this hard!

Forecasting cash flow highlighted the problem very clearly. 40% of their customers were paying late, and 25% were paying very late indeed, often 3 months or more after receiving the goods.

Meanwhile, when the business bought raw materials, they had to pay promptly for them, or suppliers would put their account on hold.

Over time, this disparity between income and expenditure had grown into a major issue.

Despite a profitable and healthy annual turnover of £600,000, they were owed £125,000 by customers who had received their orders but not yet paid the bills.

Once we got their cashflow forecasting setup, it clearly illustrated the massive scale of the problem.

If everybody had paid on time, there would be some £80,000 in the bank.

Instead, the business was running continually into overdraft.

When it was time to pay taxes, they had to go deeper into the red.

It was painful, quite literally with the stress it was causing.

Once we could see what was happening thanks to proper cash flow forecasting, we could easily fix it.

The biggest change happened when we introduced a way to classify customers according to their past payment history.

Those customers who always paid on time were allowed to continue with 30-day credit terms.

They were great customers and there was no reason to penalise them for the bad behaviour of others.

But the cash flow forecast showed just how much of a problem the persistent late-paying customers had become.

My clients hired in a financial controller who chased these overdue invoices relentlessly until the customers settled their accounts.

From this point forwards, habitual late-payers were made to pay via card at the point of ordering.

While they all protested about this change, the manufacturing business stuck to their guns.

After a few weeks of grumbling about the changes, it all settled back to normal.

No customers lost, just far better cash-flow.

The business continues to be in a strong financial position because they are still projecting cash flow to help them manage their finances over 10 years later.

How To Do A Cash Flow Forecast For Your Business

This video shows a bookkeeper explaining how to build a cash flow forecast using Microsoft Excel. I think you’ll find it very helpful – it shows simple ‘Money In’ and ‘Money Out’ sections, and allows you to plan for all the types of income and outgoings in your business.

Creating it for yourself in this way is far better than grabbing a standard template.

Why? Because you can built it suit your business exactly. When you start with an existing cash flow forecast template, it’s easy to mess it up by adding new lines that don’t get included in the formulas.

Cash Flow Forecast Template

Using the instructions in this video above, create your own cash flow template that’s completely tailored to your business. Remember to factor in late-payers and people who are likely to never pay if you want to get an accurate picture of what money is coming in.

It’s also wise to remember the tax bills – the old saying that only two things in life are certain – death and taxes – is as true for humans as it is for a business with poor cash flow!

It’s really common for businesses to forget about the tax bill until it’s due. Many people fall foul of this and your cash flow forecast is a great way to prepare yourself for the inevitable!

Cash flow problems can be a real barrier to growth in business, starving the business of the cash it needs to survive and preventing investment in improvements and innovation.

Use your own cash flow projection template to get more control over your business finances.

So now you have an idea how to project your cash flow, here is a diagram showing some of the problems of drawing up a cash flow forecast:

Common Causes of Cash Flow Problems

Lots of things can contribute to problems with cash flow. While you can identify problems when you use the projected cash flow template, you can also use this list to help you quickly find and plug holes in your cash flow management…

Cash Flow Projection For Business Plan

Putting together an estimated projection of cash flow to go into your business plan will give you insights into how the business is likely to work.

Just remember that if you’re working on a startup that most businesses tend to project cash flow optimistically, and so never achieve what is written down.

This is probably the hardest thing to do – estimating how much cash you’ll have left as a startup.

While it is an important exercise, there’s a useful golden rule or two that can help when you’re running a business for the first time.

Always have 3 months running costs on hand. 6 months if you want to be really secure. It buys you breathing space should something unexpectedly difficult happen.

This provides you with funds if the economy is in trouble and buys you breathing space to turn things around if it all goes a bit sour at some point.

Do You Need To Do Frequent Cash Flow Re-Forecasting?

Your cash flow forecast is an estimate for how your bank balance will move over the coming days, weeks or months. The frequency with which you update it should reflect the money cycle within your own business.

Think in terms of how quickly money moves through your business. The faster the money moves, the more frequently you should update your cash flow forecast. Let’s just explore that a little more with some examples.

- A business that buys stock once a week and sells it during that week would be wise to review cash flow on a weekly basis.

- If you’re dealing in large sums of cash on a daily basis – for example a solicitor moving funds for clients buying houses – then you should review your cash position and forecast every day.

- If you invoice once per month and have plenty of cash on hand, then updating your cash flow forecast each month is probably sufficient.

- If your business is running with very little cash in the bank, look at cash flow every day.

Essentially the freqyuency with which you re-forecast your cash flow should reflect the speed with which money moves through your business. The faster the movement, the more frequently you should forecast. Money going out and not coming is the simple cause of all cash flow problems. Tracking this regularly keeps you in control.

Summary Thoughts

Forecasting of cash flow is a critical exercise that gives you more control of your business.

If you create your cash flow charts in a spreadsheet, like in the video above, it’s a straightforward task to add a cash flow chart to the page as well.

When you have project cash flow statements for the weeks ahead, you can keep track of performance vs expectations.

When there is a gap between the two, you can identify the specific discrepancies and take action to ensure that your bank balance matches the figures in your cash flow forecasting template.